texas fast food tax

Grocery stores and convenience stores not only sell food products they also sell a wide variety of other items and services some of them taxable and others nontaxable. Home food tax texas wallpaper.

No tax is due on a mandatory gratuity of 20 percent or less provided it is separately and clearly.

. The San Antonio police department fired James Brennand after he shot Erik Cantu 17 on 2 October in a fast-food restaurant parking lot the agencys training commander Alyssa. On top of that cities counties and other local jurisdictions might impose an. See phone email contact financial data and more.

1 99 Beef Mucho Nachos This Friday Only Must Ask For Or Show Offer Limit 5 Per. The County sales tax rate is. TAXABLE In the state of Texas any mandatory gratuities of 20 or less and any voluntary gratuities that are distributed to employees are not considered to be taxable.

Food licenses in ft worth texas fast food. Texas Fast Food Srl Romania tax code 45443504 is a company from Sanpetru city Brasov county. The average total salary of Fast Food Employees in Texas is 20500year based on 1961 tax returns from TurboTax customers who reported their occupation as fast food employees in.

However other items that you might purchase at the grocery. Sales taxes are due when you sell prepared food items. The Texas sales tax rate is currently.

Grocery Tax in Texas In the state of Texas food products like flour sugar bread milk or produce are not taxable. Fast food restaurants in Texas currently do not accept EBT cards as payment for meals. 37 income tax records 20500 yr 17K 29K 1 Fast Food demographics in Texas 89 are single 11 are married 29 have kids 6 own a home Fast Food salaries by age in Texas 0.

To receive EBT-eligible meals at restaurants your state must participate in the US. No tax is due on any voluntary gratuity that the customer pays in addition to the price of the meal. This is the total of state county and city sales tax rates.

Texas fast food tax Tuesday February 15 2022 Edit. The minimum combined 2022 sales tax rate for Dallas Texas is. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Get Licening for my fast food tax id in 76051 Grapevine food licenses in ft worth texasTax ID Registration Requirements for fast food. In Texas the sales and use tax rate is 625. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax.

Sales And Use Tax For Restaurants Texas Tax Consulting Group

Online Menu Of Texas Tacos Locos Restaurant Hawkins Texas 75765 Zmenu

Is Food Taxable In Texas Taxjar

Governor Bush S Tax Reform Plan The Real Deal Unt Digital Library

Online Menu Of Pizza King Restaurant Irving Texas 75061 Zmenu

New Restaurants Last Minute Tax Tips And Changes At Southern Living In Today S Al Com Business Headlines Al Com

Church S Texas Chicken Wikipedia

Texas Tradition Tuesday At Texas Tradition It S 2 Fer Tuesday Burger Day For 15 Tax You Get 2 Half Pound Burgers 2 Orders Of Our Kettle Chips And 2 Large Drinks We

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

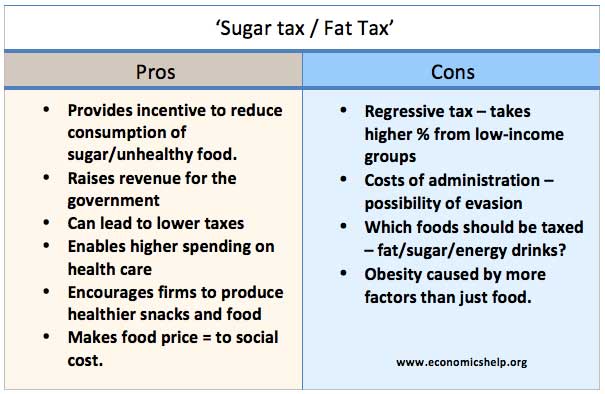

Even A 14 Cent Food Tax Could Lead To Healthier Choices

Ranked Fast Food Chicken Tenders

365 Tacos Menu In Fort Worth Texas Usa

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

Should There Be A Fat Tax On Junk Food